For the average eligible borrower, the pandemic-related deferral program increased monthly cash flow by $138 and coincided with increased credit card spending and borrowing for cars and homes.

A pandemic-driven debt relief measure freezing student loan repayments provided a large stimulus to the economy while raising long-term debt burdens, according to a study by Michael Dinerstein, Constantine Yannelis, and Ching-Tse Chen. Their findings, in Debt Moratoria: Evidence from Student Loan Forbearance (NBER Working Paper 31247), are based on comparison of financial outcomes of borrowers who were eligible for the repayment deferral and others who were not.  Until 2010, the federal government offered two loan programs that differed only in their funding sources. The US Treasury funded the William D. Ford Federal Direct Loan Program, and private banks — backed by government guarantees — funded the Federal Family Education Loan Program. In 2010, the government discontinued making new loans through private banks.

In March 2020, the federal government suspended payments by borrowers whose loans came from the Treasury. The moratorium suspended loan repayments, interest charges, and collections on defaulted loans.

To study the impact of the payment deferral, the researchers compare individuals at similar points in the lifecycle who are members of cohorts of borrowers who had both loan options available to them. They use TransUnion credit records for the period 2000 to 2022. They restrict their sample to borrowers whose most recent loan was originated no later than 2010.

The freeze on repayments put an extra $138 a month into the pockets of the average eligible borrower. By the end of 2021, the outstanding student loan balance had risen by an average of $1,500 for those who were eligible for deferral relative to those who were not.

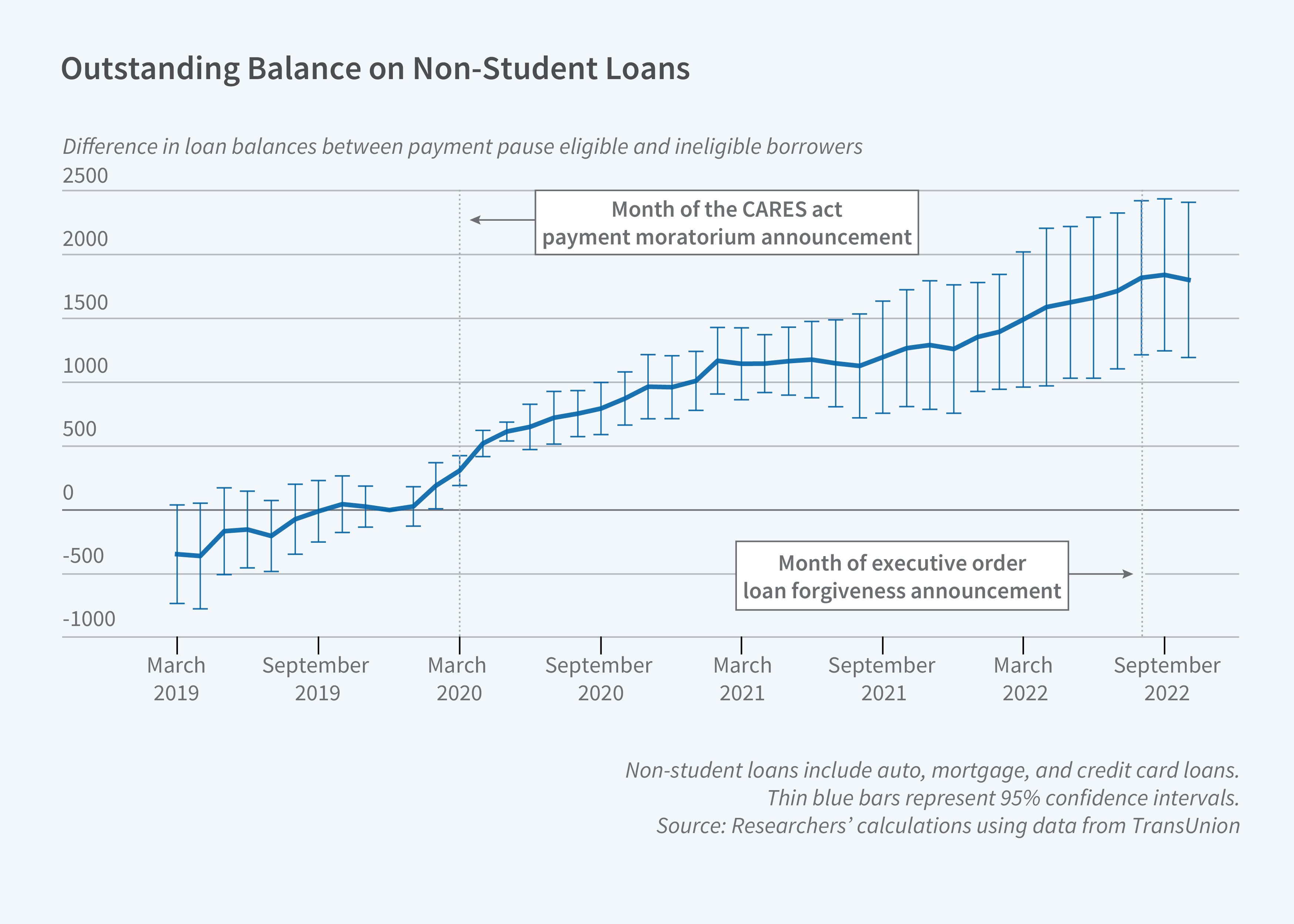

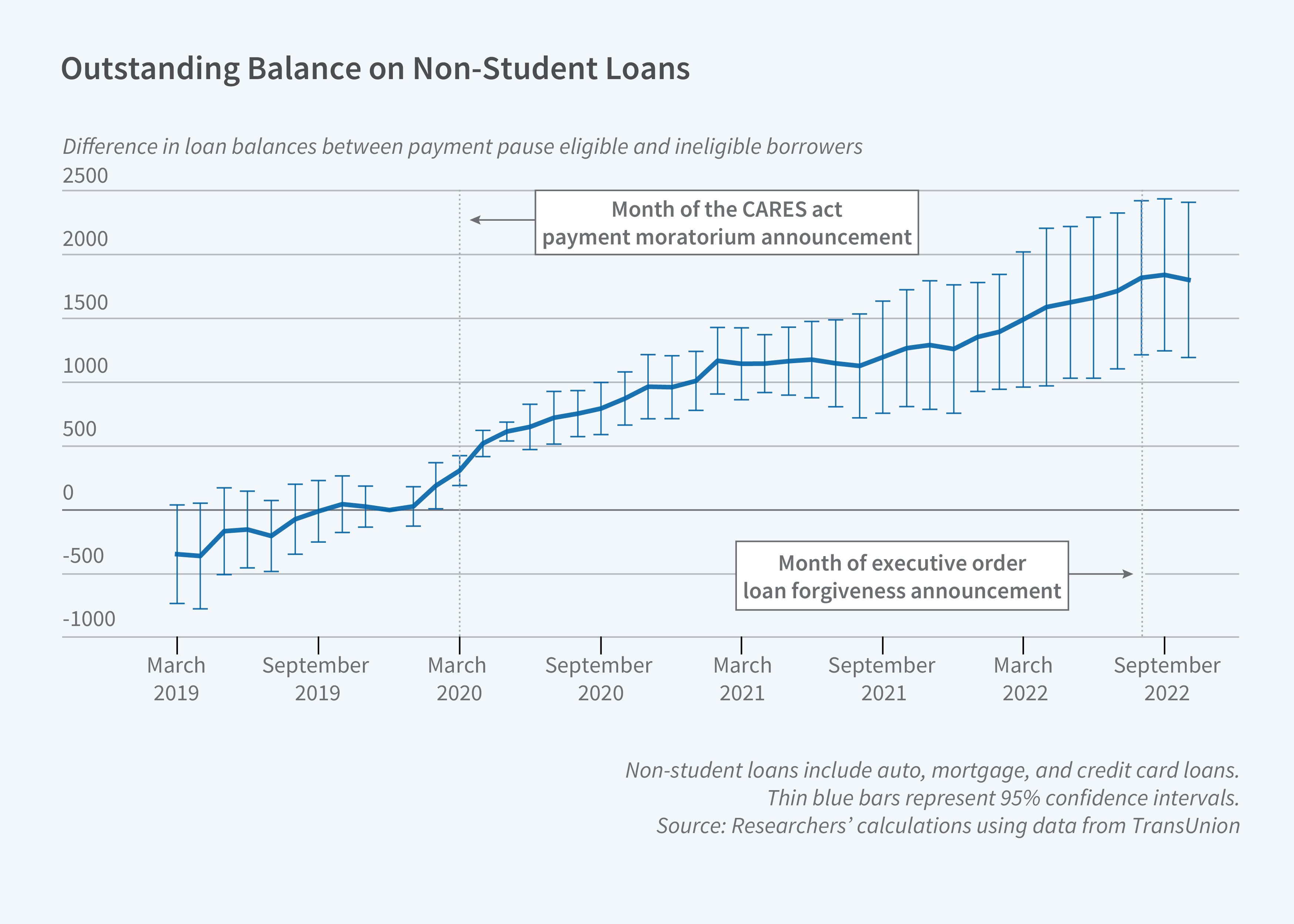

Those who benefited from deferral do not seem to have used their additional liquidity to pay off other loans. On average, they spent more and took on more debt in the form of credit card balances, car loans, and mortgages. Average nonstudent debt increased by $1,800 for those eligible for deferral, relative to those who were not, by the end of 2022.

The payment pause also raised credit scores among eligible borrowers. Borrowers with a history of delinquencies saw the largest increase, but they were less likely than those with clean credit records to take on more debt. Borrowers with past delinquencies reduced their mortgage balances by an average of $120, while those without delinquencies increased their mortgage debt by $917. The researchers argue that this outcome suggests that access to credit may be a less important driver of consumption than liquidity and the capacity to make a down payment on a car or house.

Besides benefiting from the payment moratorium, borrowers whose loans came from the Treasury became eligible for $10,000 to $20,000 in debt forgiveness under an August 2022 executive order by President Biden. This announcement does not appear to have had a significant impact on consumption, perhaps because it has not affected borrower liquidity, or perhaps because borrowers were not convinced that the executive order would survive court challenges.

The researchers conclude that it is too soon to know whether the additional consumption spending and borrowing of those whose loan payments were deferred will strengthen the overall economy by supporting productive investments and durable goods consumption, or weaken it because the higher debt burdens will deter future consumption. — Steve Maas

|

No comments:

Post a Comment